Interlace Platform

The Right Approach. Platform.

We are about creating value propositions for financial institutions. Those banks that will advance the market, will have a platform to act upon (free of limitations), and we want to give them the platform that allows them to act and advance.

Virtual Bank Account Management

Lift end-user and program operating accounts onto the Interlace Platform to launch product and programs at speed with no impact to the legacy core system.

ACH Processing

Centralize your ACH Processing across your programs to eliminate manual reconciliation with settlement automation, even across multiple middleware providers.

Payments

Centralize your payments onto the Interlace payment hub as an integrated component to the virtual bank account system.

Cards

Gain efficiencies in operations and economics with direct connections from virtual accounts to card networks.

Program Multi-Tenancy

Crafted as the ultimate real-time cloud platform, it serves banks as clients with fintech and brands as end-users, empowering banks to efficiently manage multiple programs within a unified instance.

Fraud & Compliance

Require your programs to inherent bank-level controls across KYC, KYB, AML and real-time transaction monitoring (including holds, limits and approvals).

Embedded Banking | Finance

Alternative Growth Channels

The bank no longer has exclusive ownership of last-mile delivery (their online and mobile apps). Multiple delivery providers have surfaced that include fintech applications, practice management solutions, retail brand apps, employee management platforms, correspondent bank networks.

This is where the Interlace Platform drives growth for your bank, by enabling alternative growth channels through Embedded Finance and Partner Banking.

Embedded Banking

Enabling non-banking applications to offer financial services through API-enabled products and services.

- White-label API Portal (BaaS)

- Brand Sandbox

- Centralized Compliance

Digital Brands

Enabling banks to launch a digital brand without the complexities and costs of core modernization or a sidecar core.

- Real-Time Accounts

- Speed to Market

- Accounts, Payments, Card-Enabled

Business Enablement

Enabling SMB and Commercial business models through virtual sub-account ledgering with orchestrated money movement.

- Cash Management

- Gig-Worker Platforms

- Integrated Payments

Built With Delivery in Mind

Distribution Friendly

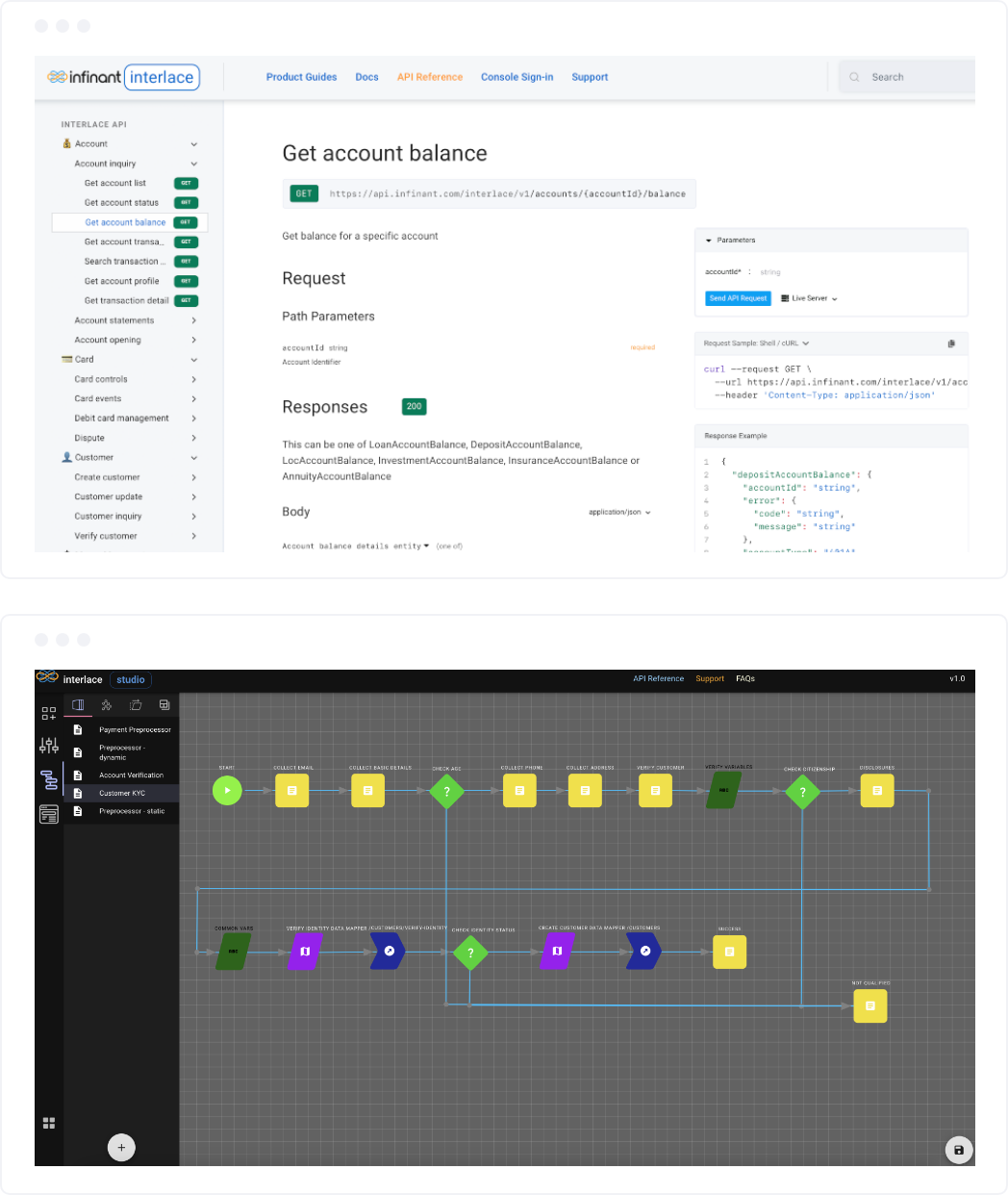

White-Label Sandbox

Provide your partners with a modern entrance to your bank that includes clean, structured APIs and Quick Start guides to accelerate their go-to-market timelines in a secure and scalable path.

Interlace Studio

Why ask the fintech to hand-code. We uniquely reduce the burden on your partners by automating the data mapping, transformation and API orchestration by generating code that can be easily embedded.

White-Label Prefabs

Go further by providing compliant prefabs that can be packaged once and deployed across all your partners in a consistent method to reduce your compliance and third-party risk management oversight.

Drive Business. Increase Revenues. Simplify.

Infinant Possibilities Await

Drive new revenue by rapidly reconfiguring product offerings and business models on an event-based cloud platform, that simplifies your path to success.

Talk with Us